ROVI achieved stable total revenue of 381.0 million euros in the first post-pandemic half year

Wed, 26/07/2023 - 01:00

4 minROVI achieved stable total revenue of 381.0 million euros in the first post-pandemic half year

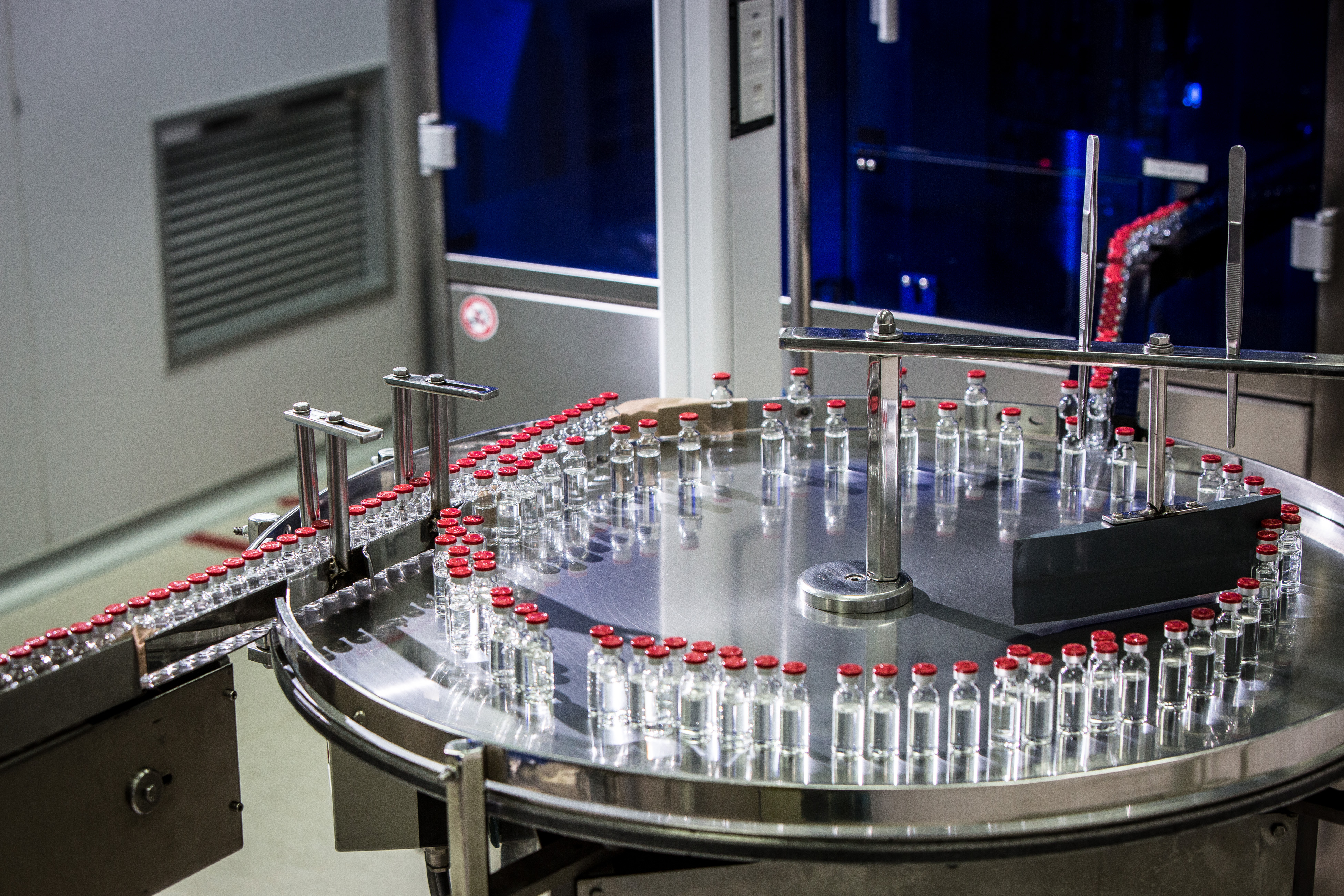

fabricas-rovi-san-sebastian-de-los-reyes.jpg

ROVI ACHIEVED STABLE TOTAL REVENUE OF 381.0 MILLION EUROS IN THE FIRST POST-PANDEMIC HALF YEAR

OUTLOOK

In November 2022 and February 2023, ROVI announced it expected the operating revenue for the full year 2023 to show a low-double-digit negative growth on 2022, although positive growth of between 5% and 10% is expected in comparison with the 2021 figure. With the visibility that the Company has at this moment, ROVI is upgrading its operating revenue guidance for the full year 2023 from low-double-digit negative growth to high-single-digit negative growth.

For 2023, ROVI is assuming a new post-pandemic scenario in which COVID-19 would foreseeably be a seasonal disease and, in principle, the vaccine would be administered once a year. The uncertainty related to the evolution of the disease is very high. It is not, therefore, possible to make a precise assessment of the impact that this new scenario could have on the CMO business. Likewise, under the terms of the agreement signed with Moderna in February 2022, ROVI is still investing in increasing the compounding, aseptic filling, inspection, labelling and packaging capacities at its facilities and expects them to be fully installed by the end of 2024.

Taking account of the aforementioned guidance on a decrease in operating revenue in 2023, as well as the fact that ROVI will continue with its investment policy as stated, it is reasonable to expect that the Company’s profits may also see a downward adjustment in 2023.

LAUNCHING OF A SHARE BUY-BACK PROGRAMME

ROVI informs the market that, effective as of today's date, 26 July, 2023, a share buy-back programme (the “Buy-back Programme”) will commence under the following terms (see further information on page 26):