Summary of the financial results for the first nine months of 2020

Summary of the financial results for the first nine months of 2020

- Operating revenue increased by 12% to 302.1 million euros in the first nine months of 2019, mainly driven by the strength of the specialty pharmaceutical business, where sales rose 6%, and the contract manufacturing business, which grew by 38%.

- For 2021, ROVI expects mid-single-digit growth rate for the operating revenue, excluding the production of the Moderna’s COVID-19 vaccine candidate. Notwithstanding, given the uncertainties associated to the development of the COVID-19 pandemic, it is not yet possible to make a precise assessment of the impact that the pandemic will have on the next year.

- For 2020, ROVI expects a mid-single-digit growth rate for the operating revenue.

- Sales of the heparin franchise (low-molecular-weight heparins (LMWHs) and other heparins) increased by 26% to 157.7 million euros in the first nine months of 2020. Heparin sales represented 52% of operating revenue in the first nine months of 2020, compared to 46% in the first nine months of 2019. Sales of LMWHs (enoxaparin biosimilar and bemiparin) increased 25%, while those of the enoxaparin biosimilar rose 45% and those of bemiparin, 10%.

- EBITDA rose by 47% to 69.7 million euros, reflecting an increase of 5.5 percentage points in the EBITDA margin, which rose to 23.1%.

- Net profit increased by 53%, from 30.7 million euros in the first nine months of 2019 to 46.8 million euros in the first nine months of 2020.

- ROVI’s General Shareholders’ Meeting held on 20 October, 2020 approved payment of a gross dividend of 0.1751 euros per share to the shareholders, charged to the 2019 profit.

- The General Assembly of Farmaindustria has unanimously elected ROVI’s CEO, Mr. Juan López-Belmonte, as the new president of the Association for the next two years.

6S3A6894.jpg

Today, Laboratorios Farmacéuticos Rovi, S.A. (BME: ROVI), a pan-European pharmaceutical company specialising and engaging in the research, development, contract manufacturing and marketing of small molecules and biological specialties, has announced its financial results for the first nine months of 2020. Operating revenue increased by 12% to 302.1 million euros in the first nine months of 2020, mainly driven by the strength of the specialty pharmaceutical business, where sales rose 6%, and by the contract manufacturing business, which grew by 38%. Total revenue increased by 12% to 303.0 million euros.

Sales of prescription-based pharmaceutical products rose 9% to 216.8 million euros in the first nine months of 2020, outperforming the market by six percentage points. According to the consulting company IQVIA, the innovative product market in Spain grew by 3% in the first nine months of 2020 in comparison with the same period of the preceding year.

In addition, sales of the heparin franchise (low-molecular-weight heparins (LMWHs) and other heparins) increased 26% to 157.7 million euros. Thus, heparin sales represented 52% of operating revenue in the first nine months of 2020 compared to 46% in the first nine months of 2019. Sales of low-molecular-weight heparins (LMWHs) increased 25% to 153.1 million euros. Sales of the enoxaparin biosimilar rose 45% to 76.6 million euros.

Likewise, sales of bemiparin, ROVI’s low-molecular-weight heparin (LMWHs) showed a positive performance during the first six months of 2020, with sales up 10% to 76.5 million euros. International sales of bemiparin increased 43% to 26.1 million euros, due mainly to the increase in transfer prices to some partners as a result of the rise in LMWH raw material prices. ROVI expects international bemiparin sales to increase at a high-teen rate in 2020.

ROVI increases sales of its prescription-based products and contract manufacturing

Sales of Neparvis®, a prescription-based product from the company Novartis indicated for the treatment of adult patients with symptomatic chronic heart failure and reduced ejection fraction, which ROVI has been distributing in Spain since December 2016, increased 42% in the first nine months of 2020, totalling 21.6 million euros.

Sales of Volutsa®, a prescription-based product from the company Astellas Pharma indicated for the treatment of moderate to severe storage symptoms and voiding symptoms associated with benign prostatic hyperplasia –distributed by ROVI in Spain since February 2015–, increased by 8% to 10.5 million euros.

Likewise, contract manufacturing sales rose 38% in comparison with the same period of the preceding year, totalling 62.7 million euros in the first nine months of 2020, driven mainly by the repositioning of the strategy of the contract manufacturing activity towards products with higher value-added.

EBITDA grew by 47% in the first nine months of 2020 in comparison with the same period of 2019, totalling 69.7 million euros, reflecting an increase of 5.5 percentage points in the EBITDA margin, which rose to 23.1% from the 17.6% recorded in the same period of 2019. Likewise, ROVI’s net profit rose 53% to 46.8 million euros.

Research and development expenses (R&D) were 15.6 million euros. These R&D expenses were mainly related to (i) the preparation of the Doria® registration dossier to be submitted to the U.S. Food and Drug Administration (FDA); (ii) the development of the Letrozole-ISM® Phase I trial; and (iii) the development of a new formulation of Risperidone-ISM® for a 3-monthly injection.

ROVI’s General Shareholders Meeting held on 20 October, 2020 approved payment of a gross dividend of 0.1751 euros per share charged to the 2019 profit, which means an increase of 119% on the dividend paid out of the 2018 profit (0.0798 euros/share) and represents a pay-out of approximately a 25% of the consolidated net profit. This dividend will be paid on 19 November 2020.

2020 ESG (Environmental, Social and Governance) Risk Rating

ROVI’s ESG (Environmental, Social and Governance) aspects have been evaluated by Sustainalytics, a global leader in Corporate Social Responsibility and Corporate Governance, having obtained an ESG risk rating of 21.8, which places the company at medium risk (between 20 and 30).

Thus, the Sustainalytics report concludes that company is at medium risk of experiencing material financial impacts from ESG factors, due to its medium exposure and strong management of material ESG issues. Furthermore, the company has not experienced significant controversies.

ROVI has attained the second position out of 360 companies in the sub-industry “pharmaceuticals”. The “pharmaceutical industry” includes biotech, pharmaceutical and laboratory equipment companies and the “pharmaceutical sub-industry” includes only pharmaceutical companies.

Moderna and ROVI Announce Collaboration for Fill-Finish Manufacturing of Moderna’s COVID-19 Vaccine Candidate Outside the United States

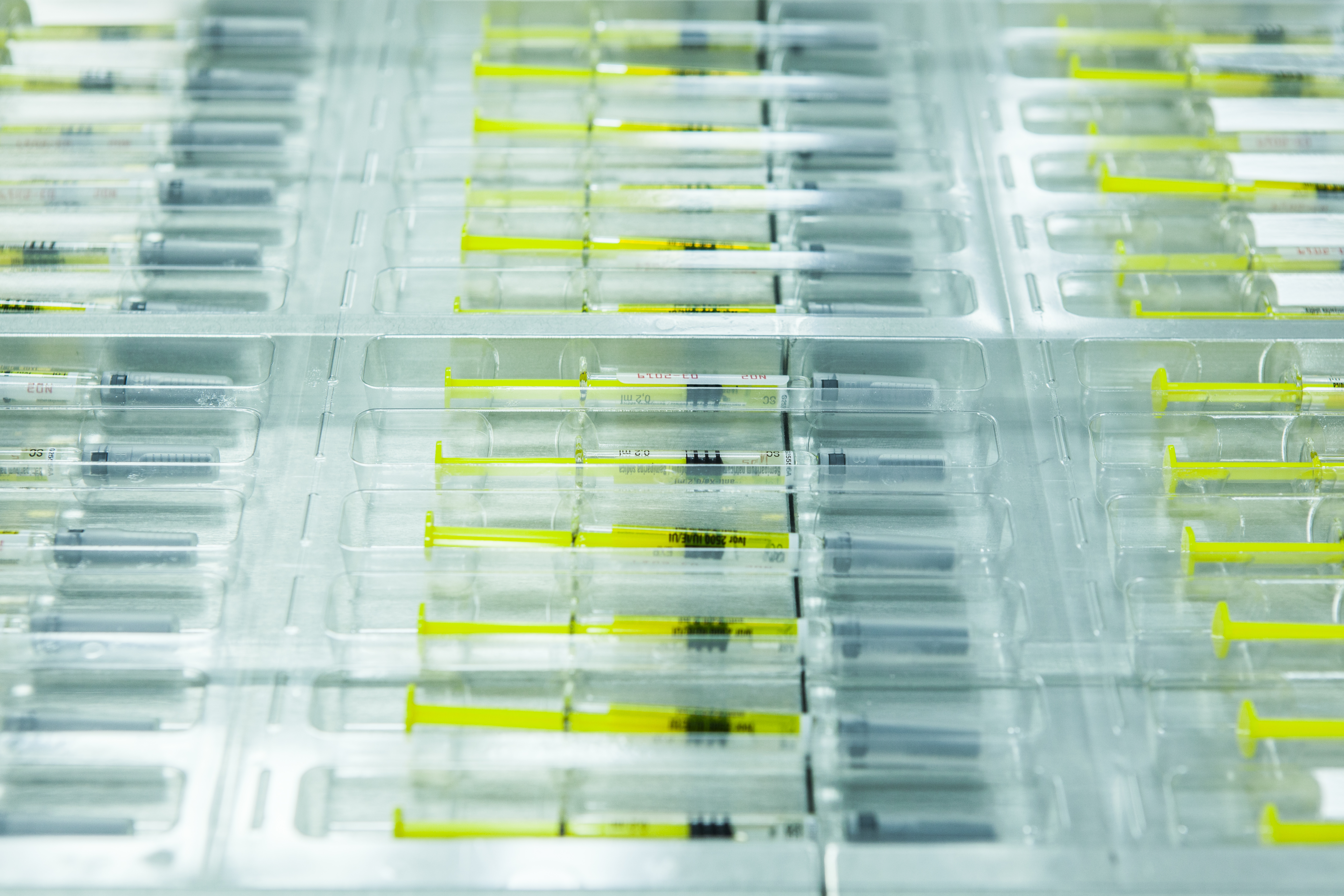

In July 2020, ROVI informed the market of the collaboration with Moderna, Inc. (Nasdaq: MRNA), a clinical stage biotechnology company pioneering messenger RNA (mRNA) therapeutics and vaccines to create a new generation of transformative medicines, for large-scale, commercial fill-finish manufacturing of Moderna’s mRNA COVID-19 vaccine candidate (mRNA-1273) at ROVI’s facility in Madrid, Spain.

As part of the agreement, ROVI will provide vial filling and packaging capacity by procuring a new production line and equipment for compounding, filling, automatic visual inspection and labelling to support production of hundreds of millions of doses of the vaccine candidate intended, in principle, to supply markets outside of the U.S. starting in early 2021. ROVI will also hire additional staffing required to support manufacturing operations and production.

Growth forecasts

For 2021, ROVI expects a mid-single-digit growth rate for the operating revenue, excluding production of Moderna’s COVID-19 candidate vaccine. The company expects to continue growing faster than the growth rate of pharmaceutical spending in Spain in the first nine months of 2020, which was 2.9%, according to the figures published by the Ministry of Health, Consumer Affairs and Social Welfare.

Notwithstanding, given the uncertainties associated to the development of the COVID-19 pandemic (which ROVI will continue to monitor closely), it is not yet possible to make a precise assessment of the impact that the pandemic will have on the next year. Likewise, the potential increase in the discounts to the National Health Service as a consequence of COVID-19 could affect the materialisation of these growth forecasts.

ROVI expects its growth drivers to be bemiparin, the latest license agreements, such as Neparvis® and Volutsa®, the enoxaparin biosimilar, its existing portfolio of specialty pharmaceuticals, the agreement with Moderna, the launch of Doria® in Europe and the new contracts in the contract manufacturing area.