Summary of financial results achieved in 2020

Summary of financial results achieved in 2020

- Operating income in 2020 increased 10% to 420.0 million euros, mainly as a result of the strength of the third-party manufacturing business, which grew 39% in sales; and the specialty pharmaceutical business, whose sales grew 4%.

- By 2021, ROVI expects operating income to increase between 20% and 30%, including the production of Moderna’s vaccine against COVID-19. However, given the uncertainties associated with the evolution of the COVID-19 pandemic, it is not yet possible to accurately assess the impact that the pandemic will have in this exercise.

- Sales of the heparin division (Low Molecular Weight Heparins (LMWH) and other heparins) increased by 14%, reaching 209.3 million euros in 2020. Heparin sales accounted for 50% of operating revenue in 2020, up from 48% in 2019. Sales of LMWH (Enoxaparin and Bemiparin biosimilar) increased by 14%, Enoxaparin biosimilar by 25% and Bemiparin sales by 5%.

- EBITDA increased 55% to reach 94.2 million euros in 2020, reflecting an increase in the EBITDA margin of 6.5 percentage points to 22.4%.

- Net profit grew 55%, from € 39.3 million in 2019 to € 61.1 million in 2020.

- ROVI will propose to the General Shareholders’ Meeting a dividend charged to the results of the year 2020 of 0.3812 euros per share with the right to receive it, which represents an increase of 118% compared to the dividend paid out of the results of the year 2019 (€ 0.1751/share) and would imply the distribution of approximately 35% of the consolidated net profit of the year 2020 (vs 25% of the consolidated net profit of 2019).

2-1024x576.png

Laboratorios Farmacéuticos Rovi, SA (BME: ROVI), company Pan-European pharmaceutical company specialized and dedicated to the research, development, manufacturing under license and commercialization of small molecules and biological specialties, today announced its financial results for the financial year 2020. Operating income increased 10% in 2020, reaching 420.0 million euros, mainly as a result of the strength of the third-party manufacturing business, which grew 39% in sales, and the specialty pharmaceutical business, whose sales grew 4%. Total revenue increased by 10% to € 421.1 million in 2020.

Sales of prescription pharmaceutical products rose 6% to € 297.0 million, outperforming the market by four percentage points. According to the consulting firm IQVIA, the market for innovative products in Spain grew by 2% in 2020 compared to 2019.

For its part, sales of the heparin division (Low Molecular Weight Heparins (LMWH) and other heparins) increased by 14% to 209.3 million euros. Thus, heparin sales accounted for 50% of operating income in 2020, compared to 48% in 2019. Sales of Low Molecular Weight Heparins (LMWH) increased by 14% to reach 202.8 million euros. Sales of the enoxaparin biosimilar increased by 25% to € 101.4 million.

In turn, sales of Bemiparin, ROVI’s low molecular weight heparin (LMWH), had a positive performance in 2020, with a growth of 5% to reach 101.4 million euros. International sales of Bemiparin increased by 21%, reaching 33.0 million euros, mainly due to the increase in transfer prices to some partners as a result of the increase in the price of LMWH raw material.

ROVI increases sales of its prescription and manufacturing products to third parties

Sales of Neparvis®, a prescription product from the Novartis company indicated for the treatment of adult patients with symptomatic chronic heart failure and reduced ejection fraction, which ROVI has distributed in Spain since December 2016, increased by 34% in 2020 until reaching 29.6 million euros.

On the other hand, the sales of Volutsa®, a prescription product from the Astellas Pharma company indicated for the treatment of moderate to severe filling and emptying symptoms associated with benign prostatic hyperplasia —distributed by ROVI in Spain since February 2015— , increased by 7%, to 14.2 million euros.

Likewise, sales of manufacturing to third parties grew by 39% compared to the previous year, reaching 91.6 million euros in 2020, mainly due to the reorientation of the strategy of manufacturing activities to third parties towards products with more added value and the registration of income related to the activities carried out under the agreement with Moderna.

EBITDA increased 55% compared to the previous year, reaching 94.2 million euros in 2020, reflecting an increase in the EBITDA margin of 6.5 percentage points to 22.4%, from 16.0% registered in 2019. Likewise, ROVI’s net profit increased 55%, to 61.1 million euros.

Research and development (R&D) expenses stood at 23.8 million euros. These R&D expenses are mainly linked to (i) the preparation of the Doria® registration dossier for submission to the US authority, the US Food and Drug Administration (FDA); (ii) the development of Phase I of Letrozole-ISM®; and (iii) the development of the new Risperidone-ISM® formulation for a quarterly injection.

ROVI will propose to the General Shareholders’ Meeting a dividend charged to the results of the year 2020 of 0.3812 euros per share with the right to receive it, which represents an increase of 118% compared to the dividend paid out of the results of the year 2019 (€ 0.1751 / share) and would imply the distribution of approximately 35% of the consolidated net profit of the year 2020 (vs 25% of the consolidated net profit of 2019).

ESG risk rating (Environmental, Social and Governance) of 2020

ESG aspects (Environmental, Social and Governance) of ROVI have been evaluated by Sustainalytics, a leading company in the evaluation of Corporate Social Responsibility and Corporate Governance worldwide, having achieved an ESG risk rating of 21.8 points, which places the company in a position of medium risk (between 20 and 30 points).

Thus, the Sustainalytics report concludes that the company has a medium risk of experiencing material financial impacts from ESG factors, due to its medium exposure and sound management of significant ESG issues. Furthermore, the company has not experienced considerable controversy.

Of the 360 companies evaluated, ROVI has obtained the second best rating in the “pharmaceutical sub-industry”. The “pharmaceutical industry” includes biotechnology companies, sanitary equipment and pharmaceutical laboratories, while the “pharmaceutical sub-industry” includes exclusively pharmaceutical companies.

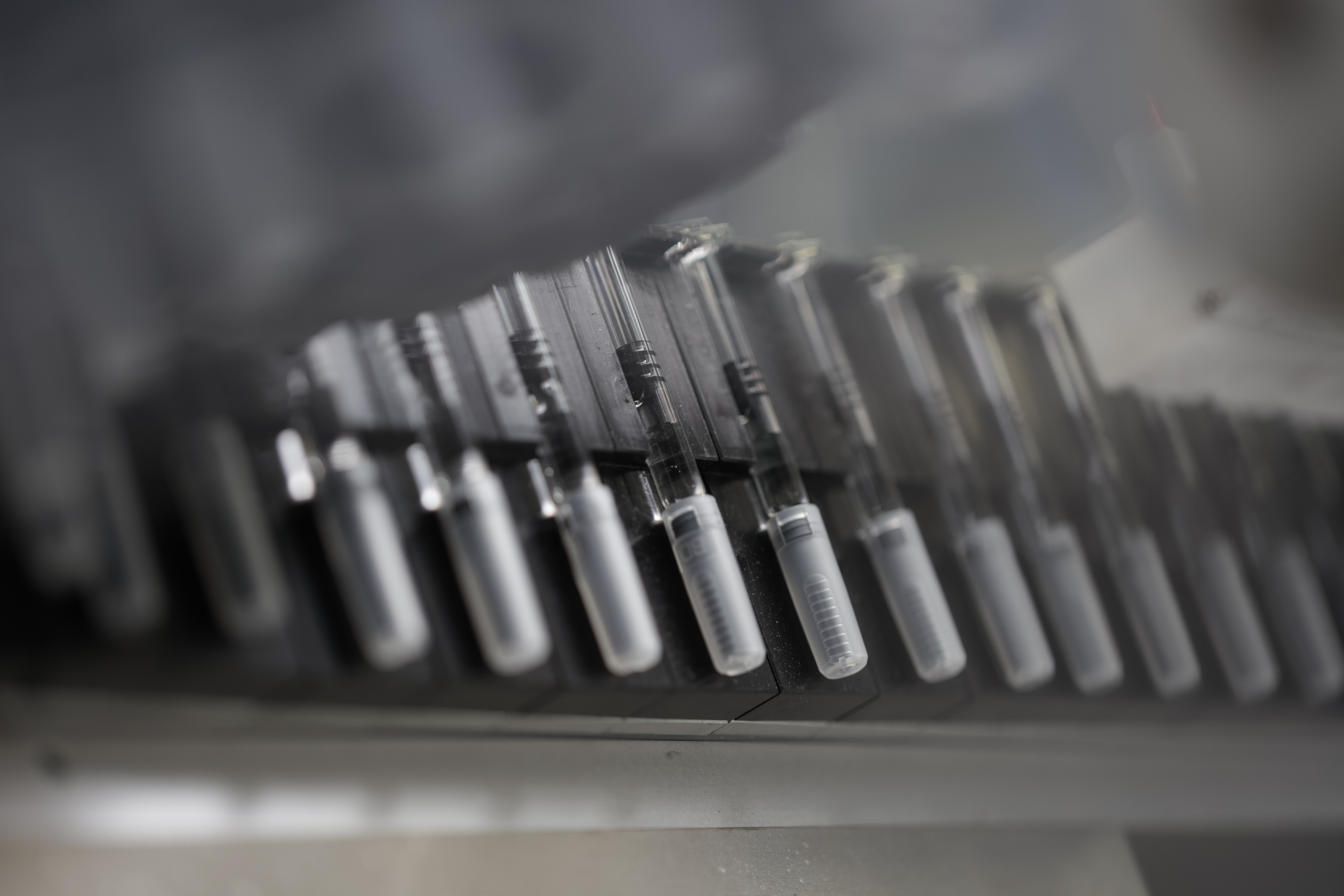

ROVI and Moderna Announce Collaboration for the Manufacturing Outside the United States of the Filling and Finishing of Moderna’s Candidate COVID-19 Vaccine

ROVI informed the market on July 9, 2020 about the collaboration with Moderna, Inc. (Nasdaq: MRNA), a clinical-stage biotech company pioneered messenger RNA (mRNA) therapies and vaccines to create a new generation of transformative drugs, for mass manufacturing scale of the filling and finishing of the Moderna mRNA vaccine candidate against COVID-19 (mRNA-1273) at the ROVI facilities in Madrid, Spain.

As part of the agreement, ROVI will provide vial filling and finishing capacity through the acquisition of a new production line and equipment for formulation, filling, automatic visual inspection and labelling to support the production of the planned candidate vaccine. , in principle, to supply markets outside the US beginning in early 2021. ROVI will also hire the additional personnel necessary for manufacturing and production operations.

Growth forecast

By 2021, ROVI expects operating income to increase between 20% and 30%, including the production of Moderna’s vaccine against COVID-19.

The Company expects to continue growing above the growth rate of pharmaceutical spending in Spain in 2020, which amounted to 2.6%, according to figures published by the Ministry of Health, Consumption and Social Welfare.

However, given the uncertainties associated with the evolution of the COVID-19 pandemic (which ROVI will continue to monitor closely), it is not yet possible to accurately assess the impact that the pandemic will have in this year.

ROVI expects its growth engines to be Bemiparin, distribution licensing agreements, such as Neparvis ® and Volutsa ® , the enoxaparin biosimilar, the existing portfolio of specialty pharmaceutical products, the agreement with Moderna and the new contracts in the third-party manufacturing area.