ROVI reports operating revenue growth of 53% and doubles its Ebitda

ROVI reports operating revenue growth of 53% and doubles its Ebitda

- Operating revenue increased by 53% to 463.5 million euros driven by (i) the strength of the contract manufacturing organization (“CMO”) business, which grew by 187%, and (ii) the specialty pharmaceutical business, where sales rose 18%.

- Total revenue increased by 53% to 464.5 million euros in the first nine months of 2021.

- EBITDA doubled to 139.5 million euros.

- Net profit increased by 111% to 98.9 million euros.

- Sales of the heparin franchise (Low Molecular Weight Heparins (LMWH) and other heparins) increased by 15% to 181.5 million euros.

- The specialty pharmaceutical business, sales rose 18% to 256,6, outperforming the market by 15 percentage points.

- ROVI General Shareholders Meeting approved the payment of a gross dividend of 0.3812 euros per share on 2020 earnings (+118%). This dividend was paid on July, 7th.

- With the visibility that the Company has at this moment, ROVI is upgrading again its 2021 operating revenue guidance from the range between 35% and 40% to the 40% and 45% range.

- ROVI’s ESG aspects have been evaluated by Sustainalytics, having obtained an “ESG Risk Rating 2021” of 18.4, which places the company at low risk (between 10 and 20). ROVI has attained the second position out of 432 companies in the sub-industry “pharmaceuticals”.

shutterstock_732664495.jpg

REVENUES

Laboratorios Farmacéuticos Rovi, S.A. (BME: ROVI), a pan-European pharmaceutical company specialized and dedicated to the research, development, manufacturing under license and commercialization of small molecules and biological specialties, registered at the end of the first nine months of 2021 a growth of 53% to 463.5 million euros in its operating revenue. This increase has been driven mainly to the CMO business sales which increased by 187%, and the specialty pharmaceutical business whose sales increased 18%. The operating revenue increased by 53% to 463.5 million euros in the first nine months of 2021, driven by the strength of the contract manufacturing organisation business, which grew by 187%, and by the specialty pharmaceutical business, where sales rose 18%. Total revenue increased by 53% to 464.5 million euros in the first nine months of 2021.

ROVI doubled its EBITDA to 139.5 million euros in the first nine months of 2021, a rise of 100% compared to the same period of the previous year, reflecting a 7.0 percentage point increase in the EBITDA margin, which was up to 30.1% in the first nine months of 2021 from 23.1% in the first nine months of 2020. EBITDA excluding expenses related to COVID-19 (“recurrent EBITDA”) increased to 141.0 million euros in the first nine months of 2021, a rise of 94% compared to the same period of the previous year, reflecting a 6.3 percentage point increase in the recurrent EBITDA margin, which was up to 30.4% in the first nine months of 2021 from 24.1% in the first nine months of 2020.

ROVI’s net profit increased by 111%, from 46.8 million euros in the first nine months of 2020 to 98.9 million euros in the first nine months of 2021. Sales of the heparin franchise (Low Molecular Weight Heparins and other heparins) increased by 15% to 181.5 million euros in the first nine months of 2021.

Heparin sales represented 39% of operating revenue in the first nine months of 2021 compared to 52% in the first nine months of 2020. Sales of Low Molecular Weight Heparins (LMWH) increased by 15% to 176.2 million euros in the first nine months of 2021.

According to IQVIA, Spanish innovative product market increased by 3% compared to the same period of the previous year, reaching 256.5 million euros in the first nine months of 2021. Nevertheless, ROVI prescription-based pharmaceutical product sales increased 18% in the first nine months of 2021, outperforming the market by 15 percentage points.

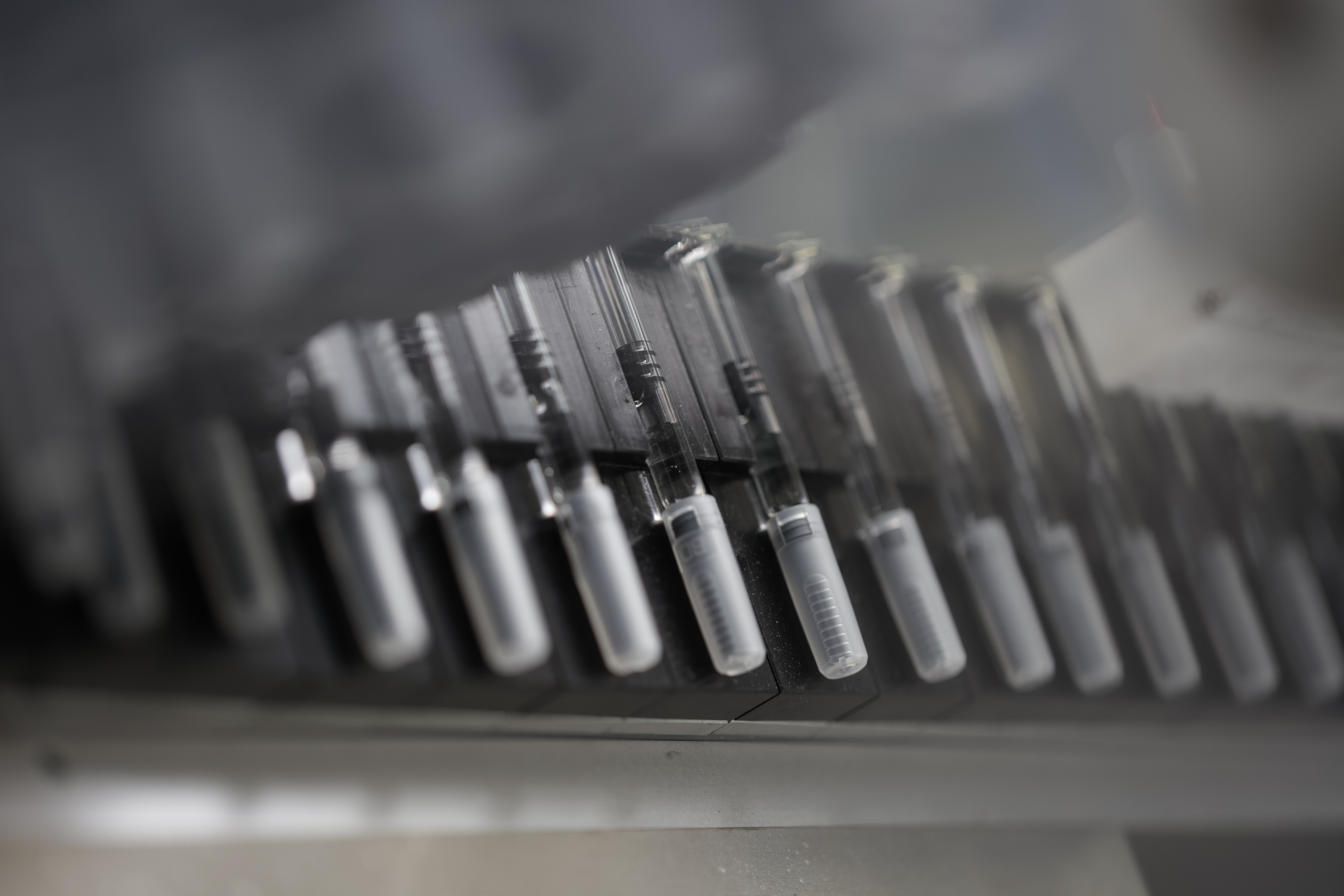

CMO sales increased by 187% to 180.2 million euros in the first nine months of 2021 as a result of (i) the booking of the income related to the production of the COVID-19 vaccine, (ii) the booking of the income related to the activities to prepare the plant for the COVID-19 vaccine production under the agreement with Moderna, and (iii) the redirection of our contract manufacturing activities strategy towards high-value-added products.

Likewise, in the year 2021, ROVI expects the toll manufacturing business to increase by between 2 and 2.5 times, including production of the COVID-19 vaccine.

ROVI General Shareholders Meeting, on 17 June 2021, approved the payment of a gross dividend of 0.3812 euros per share on 2020 earnings; it means an increase of 118% compared to the dividend on 2019 earnings (€0.1751/share) and represents a 35% pay out (vs 25% pay out last year). This dividend was paid on 7 July 2021.

OUTLOOK

In July 2021, ROVI upgraded its operating revenue guidance for the full year 2021 from the higher end of the 20% to 30% range to the range between 35% and 40%. With the visibility that the Company has at this moment, ROVI is upgrading again its 2021 operating revenue guidance from the range between 35% and 40% to the 40% and 45% range. For 2022, ROVI expects a mid-single-digit growth rate for the operating revenue.

SHARE BUYBACK PROGRAM

Today, ROVI has informed the market that, effective as of this date, 3 November 2021, a share buyback program (the “Buyback Program”) will commence, in accordance with the following terms (see further information on pages 25-26):

ESG

In August 2021, ROVI’s ESG aspects were evaluated by Sustainalytics, a Global Leader in ESG & Corporate Governance, having obtained an “ESG Risk Rating 2020” of 18.4, which places the company at low risk (between 10 and 20). This rating improves by 3.4 points the one achieved in the previous year (21.8), when the company reached a medium risk position (between 20 and 30 points).

ROVI attains the second position out of 432 companies in the sub-industry “pharmaceuticals” and 17th out of a total of 896 companies in the “pharmaceutical industry”, which includes biotech, pharmaceutical and laboratory equipment companies.